To: Interim Oversight Committee of the State Great Khural of Mongolia

Submission of Explanation and Clarification

The open hearings held by the Interim Oversight Committee to examine evidence related to “Reviewing the documents and activities associated with ensuring Mongolia’s national interests and increasing the benefits arising from the exploitation of the Oyu Tolgoi group of deposits” took place on 8, 10, and 12 December 2025.

Because the scope of the issues discussed during the hearings was broad and the allotted time was limited, we had only limited opportunities to fully express our position regarding the experts’ conclusions, to respond to questions posed by members of the Committee, and to present our views on the statements and testimonies of other witnesses. As several statements made in the experts’ conclusions and in the testimonies of certain witnesses were unfounded, inaccurate, or not reflective of the actual circumstances, we requested the opportunity to provide additional clarification. Accordingly, please accept the explanations and clarifications we are submitting herewith on the issues we consider necessary to address.

A summary of the Company’s position regarding the key issues raised during the hearings is as follows:

- On the matter of determining the reserves, valuation, and the percentage of State ownership pertaining to the “Javkhlant” (MV15225) and “Shivee Tolgoi” (MV15226) mining licenses:

The reserves within the “Javkhlant” and “Shivee Tolgoi” licensed areas constitute an integral part of the Oyu Tolgoi group of deposits. Geologically, these deposits form a single, continuous copper–gold porphyry system that extends seamlessly into the licensed area of Oyu Tolgoi LLC (OT LLC). The ore bodies within these license areas cannot be mined independently due to the absence of a technically and economically feasible standalone mining solution. The only economically viable and operationally safe option for their development is to make use of the existing underground mining infrastructure of Oyu Tolgoi LLC.

To unlock the full value of the Oyu Tolgoi group of deposits and thereby enhance returns for all shareholders, it is essential to commence the mining activities within the “Javkhlant” and “Shivee Tolgoi” licensed areas without further delay. Any postponement of mining activities adversely affects the mine plan and cost projections, which in turn creates risks for both shareholders—namely, the Government of Mongolia and Rio Tinto—by delaying dividend payments and reducing overall returns.

Accordingly, OT LLC initiated negotiations with Entrée LLC to improve the contractual terms and submitted the proposed arrangements to the OT LLC Board of Directors in March 2023. However, a decision on the matter has not yet been made.

We would also like to provide the following clarifications related to the above matter:

- Mining and Exploration: OT LLC has not planned, nor does it intend, to conduct selective or highgrading mining of the Oyu Tolgoi group of deposits. It is not feasible to carry out exploration activities across an entire deposit as large as Oyu Tolgoi simultaneously. Accordingly, exploration has been undertaken in phases, and mining operations have commenced in the most thoroughly studied sections of the deposit. Over the next five years, we plan to conduct drilling activities in the Hugo North Lift 2 and Hugo South areas. The next phase of geological studies is planned for the Heruga area. We are also working to complete the updated resource report for the Hugo North in 2026.

- Feasibility Study (FS): OT LLC has updated the Project Feasibility Study in accordance with applicable procedures every five years, and the FS was reviewed and approved by the Mineral Resources Professional Council (MRPC) in 2010 and 2015. In full compliance with its legal obligations as the holder of minerals license, OT LLC prepared amendments to the FS in 2020 and 2023, and duly submitted them to the MRPC within the required timelines, providing clarifications and explanations during multiple meetings held with the Council. Whether or not to accept the amended FS lies within the sole authority of the MRPC. To date, the process has been significantly delayed, and the issues cited by the MRPC in its conclusions and recommendations concern matters that cannot be resolved by OT LLC alone but require resolutions between the shareholders.

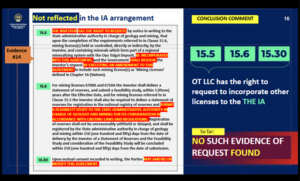

- Relevance to the Oyu Tolgoi Investment Agreement: The Oyu Tolgoi Investment Agreement (IA) expressly lists the five mining license areas that comprise the Oyu Tolgoi group of deposits. The provisions of Articles 16.31, 15.5, 15.7.8, 15.5, and 1.5 of the IA, as well as the annexes to the Agreement, address matters related to the “Javkhlant” and “Shivee Tolgoi” license areas currently held by Entrée LLC. Based on these provisions, the “Javkhlant” and “Shivee Tolgoi” license areas fall fully within the scope and applicability of the Investment Agreement. Further detail is provided in the annex hereto.

- Regarding the shareholders’ loan interest and its implications:

As Oyu Tolgoi is a largescale mining megaproject, it requires substantial investment—often amounting to several billions of U.S. dollars—before any revenue can be generated. Throughout the exploration, planning, and construction phases, the investor bears the full financial risk.

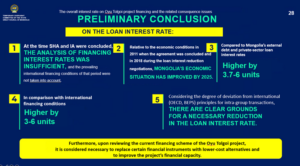

Shareholder loans are a commonly used financing instrument in projects of this nature. They allow major development to be financed without diluting ownership interests. These loans are longterm, unsecured, and provided without collateral or guarantees.

Regarding the shareholder loan interest rate, it is inappropriate and inconsistent with international standards to directly compare the interest rates on Mongolia’s external debt, privatesector loans, Rio Tinto’s own financing costs, or shortterm bonds and other internationally traded financial instruments. When assessing the interest rate applicable to OT LLC’s shareholder loans, it is essential to consider a wide range of factors, including prevailing conditions in open financial markets, projectspecific and countryspecific risks, Mongolia’s credit rating, political and economic circumstances, project implementation timeline, and the characteristics of the mining sector.

Negotiations between the shareholders of OT LLC—namely, the Government of Mongolia and Rio Tinto—are ongoing with a view to reducing the applicable interest rate on the shareholder loans.

We also wish to provide the following clarifications regarding certain issues raised during the hearings on this topic. Please refer to the annex for further details.

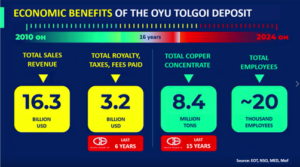

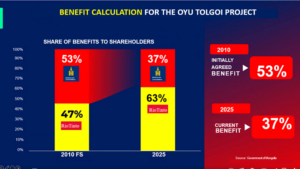

Mongolia’s share of benefits: As reflected in the 2019 amendment to the Constitution of Mongolia, the concept of benefit is defined in the minutes of the Standing Committee on State Structure dated 10 September 2019 and in Resolution No. 02 of the State Great Khural dated 9 January 2020 as comprising taxes, fees, charges, royalties, dividends, and other nontax revenues.

These components are incorporated into the methodology used to assess OT LLC’s overall economic contributions. OT LLC has applied this methodology in its Feasibility Study since 2010 to calculate shareholder returns. According to the most recent calculations, Mongolia’s total share of benefits amounts to 61 percent. As of September 2025, the foreign investor has incurred a cumulative negative cash flow of USD 11 billion, whereas the Government of Mongolia has realized a cumulative positive cash flow of approximately USD 5.3 billion. To date, the Government has not incurred any expenses and holds no debt obligations1 in connection with the project.

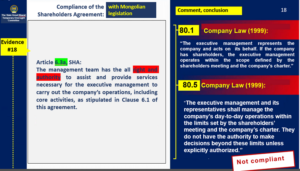

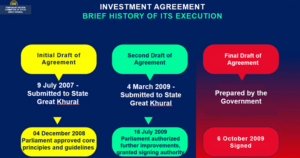

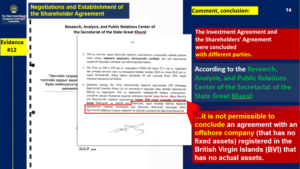

Regarding the compliance of the Investment Agreement and the Shareholders’ Agreement with the laws of Mongolia: The Investment Agreement and the Shareholders’ Agreement (including the Amended and Restated Shareholders’ Agreement) were concluded with the Government of Mongolia following extensive longterm negotiations, under public and parliamentary oversight, and are in full compliance with the relevant laws and regulations of Mongolia.

We do not agree with the experts’ conclusion that certain provisions of the Investment Agreement and the Shareholders’ Agreement are inconsistent with Mongolian law. Please refer to the annex for detailed explanations.

- Other Matters

We are deeply concerned that, during the hearings, certain members of the Interim Committee and some witnesses made serious, unfounded, and factually incorrect allegations regarding OT LLC, Rio Tinto, and specific employees. We categorically reject these baseless and serious claims.

As the Interim Committee finalizes its report and conclusions, we respectfully request that our explanations and clarifications be duly taken into consideration. This is essential to ensure that the findings of the hearings are accurate, balanced, and fair, thereby enabling the public of Mongolia to receive factual, wellgrounded information and to correctly understand the issues under consideration.

Respectfully,

Oyu Tolgoi LLC

| Parliamentary Oversight Interim Committee’s Hearing held on December 8, 2025

(Due to time constraints, responses were provided only to certain preliminary conclusions included in the inspector’s presentation. Additional clarifications or responses to other conclusions can be provided if necessary.)

|

||

| № | Preliminary Conclusions of the Interim Committee’s Inspectors | Oyu Tolgoi LLC’s Position and Clarifications |

| 1 |  |

Some of the figures referenced in the inspector’s conclusion appear to be inaccurate.

As of the third quarter of 2025, Oyu Tolgoi LLC has contributed USD 5.3 billion, equivalent to MNT 13.7 trillion, to the state and local budgets in the form of taxes, fees, and charges. This amount includes not only taxes transferred to the General Tax Authority and the General Customs Authority, but also payments made to other government agencies, including the General Authority for Social Insurance, as well as VAT paid through suppliers. Because the company does not receive VAT refunds, VAT constitutes tax expense. As OT LLC’s copper concentrate production is expected to accelerate in the coming years, the level of taxes contributed to the budget will rise proportionally. For instance, contributions are projected to exceed USD 600 million in 2026. Subsequently, once investment costs have been fully recovered, the company will begin paying income tax. It is worth noting that the Erdenet and Oyu Tolgoi mines are at different stages of their respective projects. |

| 2 |  |

There is no plan for selective mining of the Oyu Tolgoi group deposit.

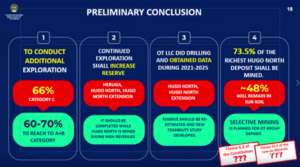

1. 24% of the Oyu Tolgoi deposit’s C-category resources are located in Hugo North, 20% in Hugo South, and 43% in the Heruga deposit. These areas represent the less-explored sections of the Oyu Tolgoi group deposit. We have planned phased exploration activities to upgrade the classification of C-category resources and improve confidence levels. Over the next five years, drilling will be conducted in Hugo North Lift 2 and Hugo South, while research work in the Heruga deposit is scheduled to begin in 2033. 2. We are currently updating the resource estimates for Hugo North and expect to deliver a revised resource report by 2026. 3. It is not feasible to conduct exploration across the entire Oyu Tolgoi group deposit simultaneously. Therefore, exploration is carried out in stages, starting with the most thoroughly studied areas, and mining operations proceed accordingly. As exploration progresses, resource classifications will be upgraded, and additional geological information on ore bodies located at depth will increase the volume of extractable resources. The figures of 73.5% and 48% cited in the inspector’s conclusion are based solely on the Feasibility Study 2023 (FS23) and the information we had available at that time. These figures will change as resource classifications are upgraded. |

| 3 |  |

Explanation on the limitations of assessing resources based on the boundaries of Entrée LLC’s mining license:

The Oyu Tolgoi group deposit is geologically a single complex mineralization system, formed during the same geological period and consisting of interconnected ore bodies. In the case of developing such large-scale porphyry deposits, international mining practice adheres to the principle of “one deposit – one mining technology.” The Investment Agreement was established based on this principle. Accordingly, the most technically and economically sound approach would be to develop the Oyu Tolgoi group deposit through: · Integrated planning of open-pit and underground mining operations. · A unified ore processing and concentration technology. · A phased and consolidated strategy for exploration and extraction. This approach ensures: · Reduced risk of selective mining and resource loss, · Gradual preparation of C-category resources for extraction, · Preservation of the overall value of the deposit over the long term. Segmenting the Oyu Tolgoi group deposit and attempting to develop each part separately using different technologies would not align with geological realities and international mining practices. Conversely, developing it as a single integrated deposit using one technology fully serves Mongolia’s long-term interests. |

| 4 |  |

Clarifications on the Inspector’s Preliminary Conclusions:

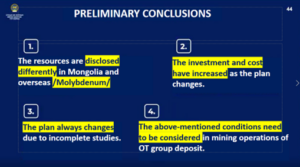

1. Considering the size, geological characteristics, and life of mine of the Oyu Tolgoi group deposit, it is practically impossible to complete all detailed studies prior to the commencement of mining. For world-class porphyry deposits (underground mines employing block caving), exploration, geological, and geotechnical studies are necessarily integrated with and conducted in phases during mining operations, which is a widely accepted international practice. 2. It is not accurate to conclude that changes in the FS are a “direct consequence of insufficient studies.” Most of these changes resulted from:

3. The conclusion that operations were “hurriedly commenced” does not reflect the actual circumstances, the legal requirements, the approved FS, and the decisions of relevant government authorities at the time. Both open-pit and underground operations at Oyu Tolgoi were implemented in compliance with applicable laws, regulations, and oversight mechanisms, based on the FS and permits valid at the time. 4. It is not reasonable to regard increased investment resulting from plan adjustments as an inherently negative outcome. On the contrary, these additional investments were necessary to

Therefore, rather than categorizing the issues mentioned in the conclusions as “non-optimal decisions” or “consequences of insufficient studies” it is more balanced and realistic to consider them within the context of the unique geological conditions of the Oyu Tolgoi group deposit, the complexity of block caving technology, and the phased planning approach commonly observed in international mining practice. |

| 5 |  |

Clarifications on the Inspector’s Preliminary Conclusions:

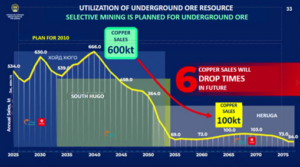

It is professionally unsound and one-sided to infer that variations in concentrate production, as shown in the presentation, reflect selective mining of underground ore or inadequate studies. In reality, Oyu Tolgoi’s operations are guided by phased exploration, integrated mine planning, and a risk-managed strategy. 1. The variations in copper concentrate production shown in the slides should be understood as indicative figures based on assumptions drawn from the Feasibility Study (FS) and mine planning documents available at the time. These figures are subject to change depending on subsequent geological study results, resource classification upgrades, and optimization of mining sequences. They should not be regarded as final or fixed conclusions. 2. The pattern of higher copper concentrate production in the early years followed by a later decline does not indicate selective mining of underground ore. Rather, it reflects the typical production curve commonly observed in large porphyry deposits. At the start of operations, blending high-grade ore from the open-pit Oyu deposit and the underground Hugo North deposit results in higher concentrate output. This is a geological reality, not a consequence of insufficient studies. 3. Throughout the mine’s life, the concentrator’s ore processing capacity has remained stable at approximately 40 million tons per year, demonstrating the consistency of mine and concentrator capacity, technology, and infrastructure. The decline in concentrate output is due to natural variations in ore grade, which is a geological condition, not a planning error. 4. Geological exploration and detailed studies currently underway at Hugo North Lift 2 enable phased preparation of C-category resources for extraction and provide opportunities to optimize mining sequences and update plans as needed. Therefore, the phased and systematic planning and implementation of studies and exploration at Lift 2 and other ore bodies is a strategic measure aimed at mitigating risks arising from geological uncertainty. It is unfounded to characterize these actions as “errors caused by delayed studies.” |

| 6 |  |

Clarifications on the Inspector’s Preliminary Conclusions:

Oyu Tolgoi LLC prepared a detailed Feasibility Study (FS) for the open-pit mine and concentrator, as well as an order-of-magnitude study for the underground mine, which were reviewed and approved by the Mineral Resources Professional Council (MRPC) in 2010. Based on these approvals, project development and operational activities commenced in compliance with applicable laws and regulations. Subsequently, a detailed FS for the underground mine was developed in 2015, reviewed and approved by the MRPC, and became the primary reference document for underground operations. In accordance with FS requirements and relevant regulations, Oyu Tolgoi LLC has fulfilled its obligation to update the FS every five years, submitting official amendments to the MRPC in 2020 and 2023. As the holder of a mineral license, Oyu Tolgoi LLC has consistently met its responsibility to prepare and update the FS. The acceptance and approval of these FS documents and their amendments are determined by the MRPC through a formal review process in accordance with law and regulation. Therefore, the conclusion that “Oyu Tolgoi LLC has operated without an approved FS for the past 10 years” is inconsistent with legal requirements and actual practice. Rather, it reflects a misinterpretation of the procedural stages of MRPC review and decision making. |

| 7 |  |

We disagree with the inspector’s conclusion.

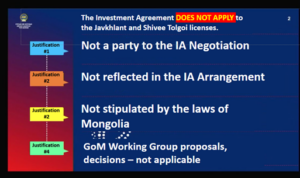

The Investment Agreement (IA) between Oyu Tolgoi LLC and the Government of Mongolia defines the issues related to the Javkhlant and Shivee Tolgoi mining licenses held by Entrée LLC as follows: Clause 16.31 of the IA specifies that “Mining Licenses” shall mean […] the mining licenses referred to in Clause 15.7.8 of this Agreement and other tenure incorporated under Clause 15.5. Clause 15.7.8 refers specifically to the Javkhlant and Shivee Tolgoi licenses. In summary, regardless of whether the the Javkhlant and Shivee Tolgoi licenses were incorporated under Clause 15.5, they are defined as “mining licenses.” Clause 16.11.2 of the Investment Agreement states that “all such other additional areas of Mining Licenses and other tenure incorporated under Clause 15.5”, meaning that the areas covered by the Javkhlant and Shivee Tolgoi licenses, defined as mining licenses in the Agreement, fall within the “Contract Area” and, under Clause 1.5, are subject to the provisions of the Investment Agreement. |

| 8 |  |

We disagree with the inspector’s conclusion.

The justification for including the Javkhlant and Shivee Tolgoi licenses under the Oyu Tolgoi Investment Agreement has been clearly outlined above. On this basis, these licenses fall under the scope of the IA without the need for a separate request for inclusion. This explanation has previously been provided to the Interim Committee and the inspectors. However, the conclusion presented at the hearing appears to reflect a one‑sided interpretation of the matter. |

| Hearing on December 10, 2025

(Due to time constraints, responses and comments have been provided only to certain preliminary conclusions included in the expert presentation. If necessary, additional responses and clarifications to the remaining conclusions can be provided.) |

||

| No. | Preliminary Conclusions of the Interim Committee’s Experts | OT LLC’s Position and Comments |

| 1 |  |

The Investment Agreement was concluded in full compliance with the laws and regulations of Mongolia as a result of extensive, long-term negotiations with the Government of Mongolia. Throughout the negotiation process, all relevant laws and regulations were fully complied with, and the negotiations were conducted under broad public and parliamentary oversight. |

| 2 |  |

We are in disagreement with the experts’ conclusion.

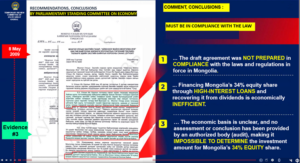

Annex 2, Resolution #40 of 2008 by the State Great Khural of Mongolia approved the basic principles and guidelines for concluding an investment agreement for the joint development of the Oyu Tolgoi copper-gold deposit. Pursuant to that resolution, it was instructed to examine a “production-sharing–based option” when negotiating the investment agreement. However, the Mongolian laws in force at that time, including the Law on Minerals, did not provide for the conclusion of an investment agreement based on the production sharing principle. Consequently, in compliance with the applicable laws, it was agreed that the state-owned share would be 34 percent, and that this share could be further increased to 50 percent, and this was reflected in the Investment Agreement. Therefore, concluding that the equity participation of the State, and the related option of investor-provided financing, was a “poor option” is not consistent with the legal and regulatory framework in force at the relevant time. Furthermore, the OT Shareholders’ Agreement is not confidential and has been publicly disclosed on Oyu Tolgoi’s website and other public sources. |

| 3 |  |

We are in disagreement with the experts’ conclusion.

Article 29 of the 2006 Minerals Law, which was in force at the time the Investment Agreement was concluded, provided that an investment agreement may be entered into in order to maintain stable conditions for an investor’s operations for a certain period of time, and that such agreement may include provisions on the stabilization of the tax environment and other related matters. Within this legal framework, the parties negotiated and agreed on the terms of the Investment Agreement, and therefore the draft agreement was prepared in full compliance with the laws and regulations of Mongolia that were in force at the relevant time. |

| 4 |

|

The experts’ conclusion is unfounded.

The meeting minutes of the Government of Mongolia dated 6 October 2009 (Minute #62) state that “the State Property Committee and the Board of Directors of Erdenes MGL LLC (D. Sugar) are instructed to grant, in accordance with the applicable laws, the authority to B.Enebish, Chief Executive Officer of Erdenes MGL LLC, to sign the Shareholders’ Agreement of Ivanhoe Mines Mongolia Inc. LLC on behalf of Erdenes MGL LLC.” Pursuant to this decision, Resolution #22 of Erdenes MGL LLC dated 2009 granted B.Enebish, Chief Executive Officer of Erdenes MGL LLC, the authority to sign the Shareholders’ Agreement of Ivanhoe Mines Mongolia Inc. LLC. |

| 5 |  |

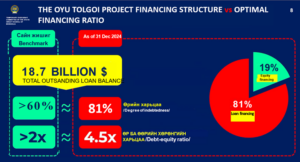

Development costs and financial structure are critically important in assessing the long-term value of a project.

Capital expenditure refers to the upfront investment required to transform an orebody into a mine. This includes the development of an open pit or underground mine, procurement of equipment, construction of a concentrator, tailings and waste storage facilities, provision of power and water supply, and the development of infrastructure such as roads, maintenance workshops, and worker accommodation. Large-scale projects such as Oyu Tolgoi are planned over many years, with cost estimates being refined in detail at each stage. Oyu Tolgoi is now entering a critical phase in 2025–2026. With the completion of underground mine development and the transition to fully integrated operations, cash flows are expected to turn positive, enabling the repayment of loans incurred to transform the orebody into a world-class mining operation. |

| 6 |  |

The interest rate on shareholder loans cannot be directly compared to Mongolia’s external debt, private sector loans, or interest rates of international financing institutions.

When comparing interest rates, it is necessary to take into account numerous factors, including the terms and risks of the loans, the country’s credit rating, political and economic conditions, the purpose of the loan (such as working capital loans, working capital financing loans, equipment purchases, or the comprehensive introduction of new technologies or construction of facilities), the project implementation period (short-term or long-term, e.g. one year, five years, etc.), and the sector in which the project is implemented (mining, food, light and heavy industry, agriculture, information technology, etc.). The loan received by OT LLC from its shareholders is characterized as unsecured, not backed by any collateral or guarantees, and repayable only after all senior debt has been satisfied. |

| 7 |  |

The concept of “benefits” introduced in the Constitution of Mongolia in 2019 is defined in the meeting minutes dated September 10, 2019 by the Standing Committee on State Structure, and Resolution #02 dated January 9, 2020 by the State Great Khural to include taxes, fees, payments, profits, dividends, royalties, and non-tax income. These components are consistent with the benefit calculation methodology that OT LLC has applied to determine Mongolia’s share of project benefits, and they are fully reflected in the company’s financial calculations.

Furthermore, OT LLC has applied a consistent methodology for calculating benefits since 2010, and according to the most recent calculation, Mongolia’s share of the benefits is estimated at 61 percent. However, the experts presented a calculation indicating that Mongolia’s share is 37 percent and disseminated this information to the public without explaining which components were included or how they were assessed, which is inappropriate. |

| Hearing on December 12, 2025

(Due to time constraints, responses and comments have been provided only to certain preliminary conclusions included in the expert presentation. If necessary, additional responses and clarifications to the remaining conclusions can be provided.) |

||

| No. | Preliminary Conclusions of the Interim Committee’s Experts | OT LLC’s Position and Comments |

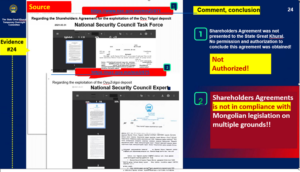

| 1 |  |

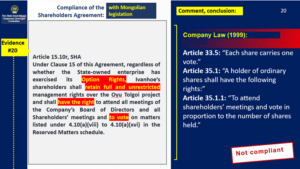

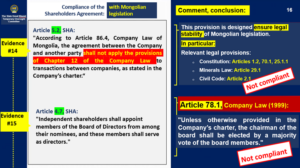

We are in disagreement with the experts’ conclusion.

The experts concluded that the Shareholders’ Agreement lacked authorization from the State Great Khural, without providing any explanation of the legal basis on which such an agreement would require authorization from the State Great Khural, rendering their conclusion overly biased. The Shareholders’ Agreement is an agreement entered into between a company’s shareholders in accordance with the Company Law of Mongolia and is governed by the Civil Code. Therefore, there is no legal requirement for such an agreement to be discussed or authorized by the State Great Khural. |

| 2 |  |

The experts’ conclusion is unfounded.

The Investment Agreement was executed with the signatures of the Minister of Finance, the Minister of Mineral Resources and Energy, and the Minister of Environment and Tourism as per Article 29.2, Minerals Law of Mongolia in force in 2009, which stipulates that an Investment Agreement shall be jointly executed by the Cabinet members responsible for finance, geology, mining, and environmental matters, upon authorization by the Government of Mongolia. While, under the Company Law, the Shareholders’ Agreement must be executed by the shareholders of the relevant company. Therefore, the Shareholders’ Agreement was duly executed by duly authorized representatives of the shareholders of OT LLC, and this does not constitute a violation of law. |

| 3 |  |

We are in disagreement with the experts’ conclusion.

As explained above, the Shareholders’ Agreement (Amended and Restated Shareholders’ Agreement) is an agreement entered into between the shareholders of the company in accordance with the Civil Code. The parties to the agreement have mutually agreed on this arrangement as per Article 189.1 of the Civil Code, which provides that the parties to the agreement have the right to determine the content of the agreement themselves. With respect to negotiations involving a conflict of interest, this arrangement was included in the agreement in accordance with Article 86.4 of the Company Law in force at the time (currently Article 89.4), which permits specifying circumstances in which the provisions of Chapter 12 do not apply. Regarding Clause 4.7(a) referenced by the expert, the Shareholders’ Agreement (including the Amended and Restated Shareholders’ Agreement) and the Charter of OT LLC provide that the provisions of the Shareholders’ Agreement form an integral part of the Company’s Charter. In other words, because the law permits alternative arrangement in the Company’s Charter, the shareholders agreed to such terms. This is fully consistent with the laws of Mongolia. |

| 4 |

|

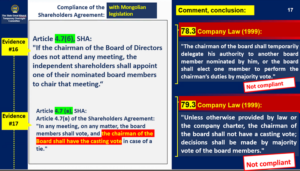

We are in disagreement with the experts’ conclusion.

Articles 78.1 and 79.3 of the Company Law of Mongolia (1999), which was in force in 2009, allow for “permissible” arrangements to be specified in the Company’s Charter and in the operating procedures of the Board of Directors, enabling the chairman’s casting vote to resolve matters in the event of a tie among the board members. In addition, pursuant to the Shareholders’ Agreement (including the Amended and Restated Shareholders’ Agreement) and the Charter of OT LLC, the provisions of the Shareholders’ Agreement are deemed to form an integral part of the Company’s Charter. In other words, because the above legal provisions expressly allow alternative arrangement in the Company’s Charter, the shareholders agreed to such terms. |

| 5 |

|

The experts’ conclusion is not consistent with the fundamental content and principles of the Company Law.

Both the 1999 and 2011 Company Laws stipulate that a company’s governance structure consists of shareholders, a board of directors, and executive management (either collectively or individually), but they do not impose restrictions prohibiting alternative management structures. In other words, based on both the private law “principle of freedom of contract parties” and the public law principle “what is not prohibited is permitted”, the conclusion that having a Management Team as mentioned here is inconsistent with the Company Law, is biased. |

| 6 |

|

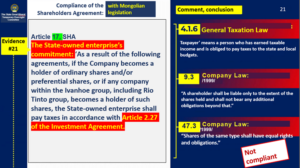

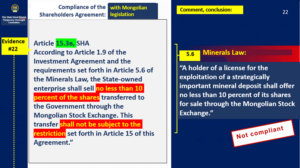

We are in disagreement with the experts’ conclusion.

As explained above, the Shareholders Agreement (Amended and Restated Shareholders’ Agreement) is an agreement between shareholders of a company in accordance with the Civil Code. The parties mutually agreed on this arrangement, as stipulated in Article 189.1 of the Civil Code, which states that the parties to an agreement have the right to determine the content of the agreement themselves. |

| 7 |

|

We are in disagreement with the experts’ conclusion.

This provision addresses only the tax obligations of the state-owned company in which the Government of Mongolia holds shares, in cases where the five types of transactions specified therein occur (including: distribution of dividends from OT LLC to Erdenes MGL; provision of financing or loans from another shareholder to Erdenes MGL; and repayment of shareholder loans of Erdenes MGL, including related interest payments). This arrangement does not restrict OT LLC from performing its role as a withholding agent. It is therefore overstated to include unrelated clauses here and conclude that they have been violated. Also, Article 17 is agreed upon in accordance with Clause 2.27 of the Investment Agreement, and the Investment Agreement is executed in accordance with the laws of Mongolia. |

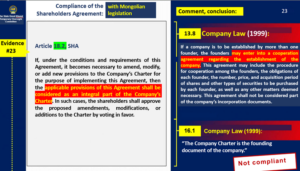

| 8 |  |

We are in disagreement with the experts’ conclusion.

Fulfilling obligations established by law is the responsibility of the Government and its authorized representatives. Portraying OT LLC as being at fault or in violation of the law for the Government’s failure to implement such obligations and take appropriate actions, and recording it as “non-compliant,” is misleading. This should be corrected to provide the public with an accurate understanding. |

| 9 |

|

We are in disagreement with the experts’ conclusion.

The Company Law does not restrict the parties from defining and agreeing on the interrelationship between the Charter and the Shareholders’ Agreement. However, the experts concluded as if these two documents should have no relation to one another, and we do not agree with such a conclusion. |